Tax Season Newsletter

Welcome to TAX SEASON 2024!

It’s that special time of the year again! As we adapt to a new normal post-pandemic, the world of taxation is also evolving. Our Newsletter is designed to provide you with essential housekeeping information, aimed at making your tax preparation process smoother and more straightforward.

Welcome to TAX SEASON 2024!

It’s that special time of the year again! As we adapt to a new normal post-pandemic, the world of taxation is also evolving. Our Newsletter is designed to provide you with essential housekeeping information, aimed at making your tax preparation process smoother and more straightforward. While we won’t be covering detailed tax law updates here, you can easily find all the latest 2024 tax season law updates on our website. Our goal with the Newsletter is to simplify the complexities of tax season for you, helping you navigate through with ease and efficiency. Let’s work together to make this tax season less daunting and more manageable. Here’s to making taxes less taxing! 😄📊🧾👍

Office Hours & Service Information

Our virtual office is open Monday to Friday, from 9:00 AM to 4:00 PM during tax season.

Please note that during the 2024 tax season, you file taxes for the 2023 tax year. Also, we operate on a first-come, first-served basis. All calls, texts, and emails will be responded to within 24 hours. Typically, tax preparation services are completed within 24 hours once all necessary information is received. However, during particularly busy periods, there might be a slight delay beyond the 24-hour processing time. Thank you for your understanding and patience.

2024 Key Tax Dates

- Early Actions: From January 2, 2024, you can apply for Fast Cash Advance and start filing your tax returns early.

- Official Start: National Tax Return filing begins on January 29, 2024.

- Refund Release: If your refund includes EITC and ACTC, expect it from February 27, 2024.

- Main Deadline: April 15, 2024, is the final date for filing federal tax returns and payments.

- Extension Cut-off: If you request an extension, October 15, 2024, is your last day to file.

Tax Preparation Fees

Our approach to tax preparation fees is tailored to the specific needs of each tax return. We do not have a one-size-fits-all flat fee; instead, our pricing is based on the individual forms required for each tax return. The total fee is calculated by adding up the charges for each form, with the cost varying according to the complexity of the form. Our tax preparation fees include valuable complimentary services. This includes free state tax prep (unless filing for multiple states) and no charge for separate dependent tax returns if they’re included on your return. These benefits are part of our commitment to offer comprehensive, yet affordable, tax services.

Pricing Examples

To give you a clearer idea of our pricing, here is an average cost estimate for filing some of the more common tax forms:

Standard Tax Filings:

A basic 1040 form, including Schedule A (Itemized) and with dependents, is typically around $460.

For a non-itemized Form 1040 with no dependents, the average cost is $125.

Refundable Credit Forms:

Tax forms that result in refundable credits generally range from $65 to $85 per form.

Child-Related Credit Forms:

Forms involving credits for dependents, such as children, vary from $35 to $55 per form.

Income Reporting Forms:

Forms used to report income, such as W2s, 1099s, etc., can cost between $10 and $125 per form, depending on the complexity.

Additional Pricing

-

Please be aware that if significant changes are needed after I have fully prepared your tax return, a fee of $100 will be incurred for these adjustments. This applies when more than one form requires alteration. Common examples include but no limited to adding or removing a dependent after the return is complete, or a married couple choosing to file separately instead of jointly. Such changes often necessitate modifying several forms to ensure your refund is maximized, resulting in additional work. You’re understanding and cooperation in this matter are greatly appreciated to ensure a smooth and efficient tax preparation process.

Tax Refund Estimate

For new clients ONLY, we provide a complimentary service of estimating both your tax preparation fees and your expected refund amount. This free refund estimation helps you understand the costs and potential returns upfront since we do not have a flat fee tax preparation fee.

For our returning clients, we don’t offer free estimates due to the time-intensive nature of preparing them. Instead, you can easily estimate your costs by looking at your fee from the previous year, especially if your financial situation remains similar. This approach saves both time and resources, making the process more efficient for everyone.

Options To Pay Fees

-

You have two main choices for handling your tax preparation fees:

- Deduct from Refund: opt to have the fees deducted directly from your tax refund. Please note, this method incurs additional bank fees.

- Pay Upfront: Alternatively, pay out of pocket at the conclusion of your tax preparation. This option avoids the extra bank fees associated with deduction from your refund.

Please indicate in your tax preparation package which payment method you prefer.

Note:

Applying for the advance requires submitting your tax return to the IRS. Once accepted, your loan application goes to the bank, with a decision made within 24 hours. Fast Cash Advance is an optional tax-refund related loan provided by First Century Bank, N.A., Member FDIC (it is not the actual tax refund).The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer from the refund.

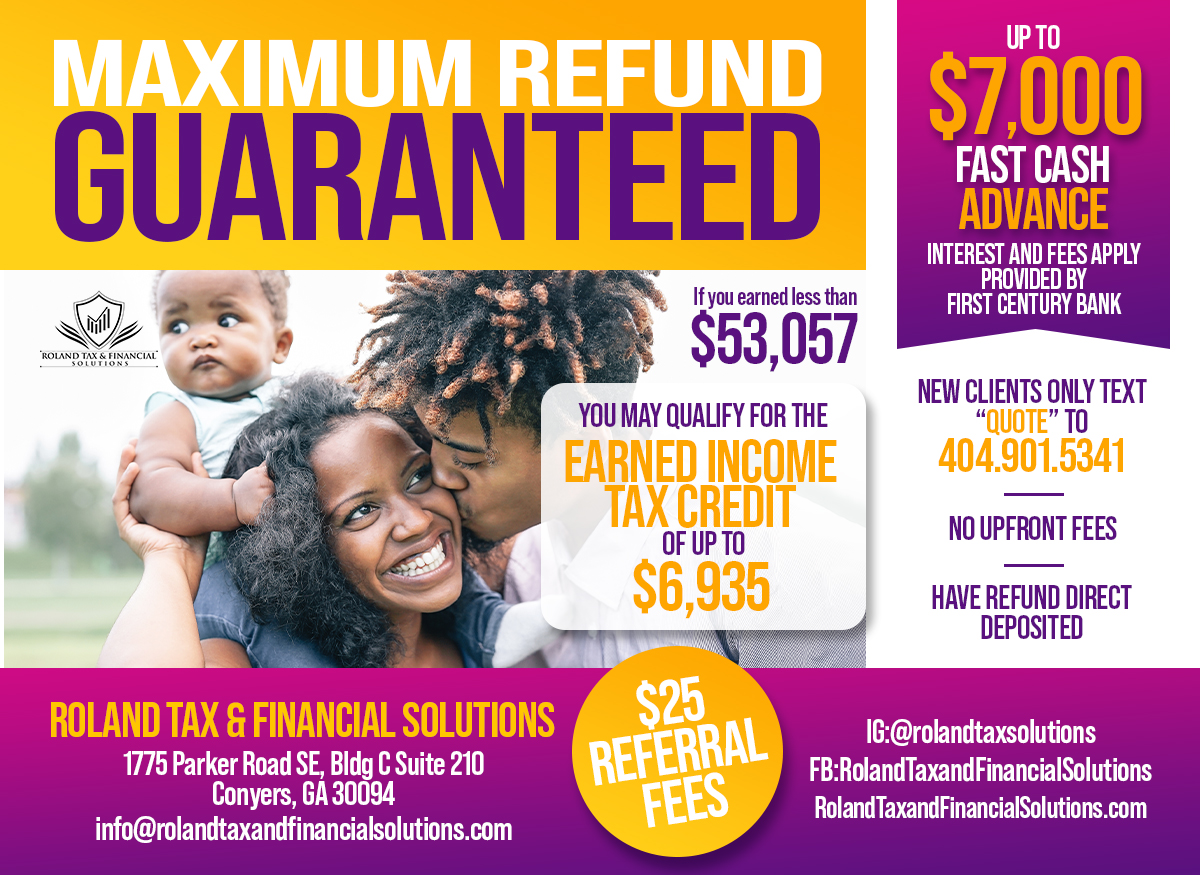

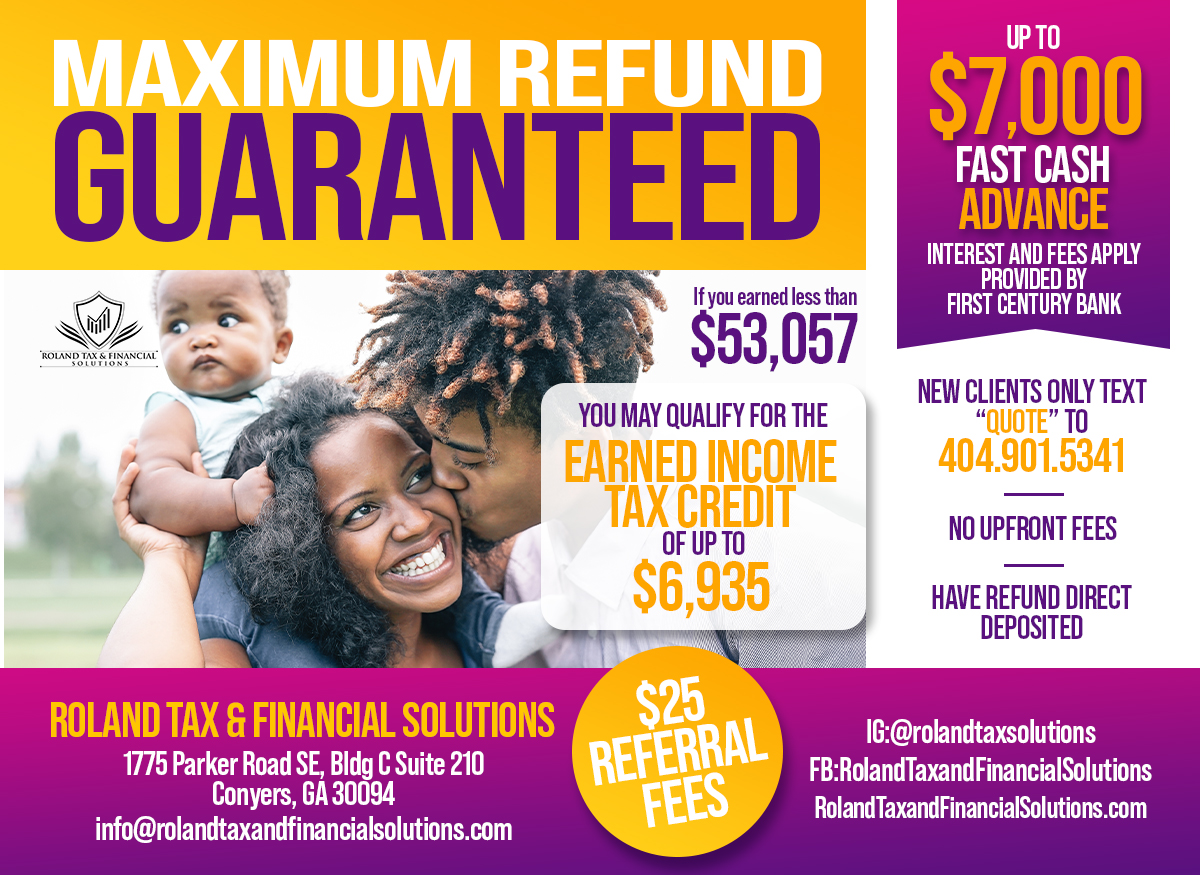

Fast Cash Advance

Fast Cash Advance is an optional tax-refund related loan and a great option for tax clients that can’t wait weeks for their tax refund.

- Availability: Get advances up to $7,000 from January 2 to March 17.

- Method: Choose direct deposit or check for receiving advances.

- Fees: $79.90 processing fee for early filers starting January 2, 2024; $39.95 thereafter, deducted from your tax refund.

- Application: Request via the 2024 Tax Season Preparation Package.

- Notification: Learn about approval or denial through email or text.

- Disbursement Process:

- If Approved: The advance is disbursed within 24 hours to the option specified in your tax prep package. If the advance is less than your total refund, the remaining amount will be paid by the IRS when refunds are released and disbursed as you indicated in the package.

- If Denied: Your entire refund will be issued by the IRS once they start releasing refunds and disbursed according to your specified method in the package.

Tax Refund Disbursement Options

-

Once your refund is processed and any tax preparation fees are settled, you can choose from several convenient methods to receive the remaining funds:

- Green Dot® Prepaid Visa® Card: A safe and straightforward alternative to paper checks. Your refund is loaded onto the card for easy access.

- Direct Deposit: Have your refund deposited directly into your checking or savings account. Funds usually arrive within 1-2 business days after the IRS or state releases them. (HIGHLY RECOMMEND)

- Cashier’s Check: Tax professionals can issue a cashier’s check from their office once the IRS or state funding is received. More information is available about where these checks can be cashed.

Note:

To ensure a smooth tax filing process, please provide all necessary documents. These can be scanned and emailed to us; alternatively, you can take photos with your phone and email them. For security reasons, avoid sending sensitive information via text. Send all documents to [email protected]. Remember, we can’t start preparing your tax returns until we have all required documents from you, your spouse, and any dependents (if applicable).

Documents Needed

-

Documents needed include:

- State-Issued Driver License/ID: Please scan and include for yourself, spouse, and dependents, if applicable.

- Social Security Card: Scanned copies are recommended for you, your spouse, and dependents.

- Bank Details for Direct Deposit: A voided check or bank statement showing account routing and numbers (only for clients who want direct deposit of refunds).

- All Tax-Related Forms: This includes, but is not limited to, W2s, 1099s, 1098Ms, 1098Ts, SSAs. For anyone who attended college in 2018, please check student portals for any relevant tax forms. This applies to both returning and new clients.

- Selfie for Identification: Required only for new clients for additional verification.

.

Audit Protection

-

TAX AUDIT DEFENSE PROVIDED BY PROTECTION PLUS

This year our program includes our new $1 Million Tax Audit Defense and complete ID Theft Restoration services. If you receive a notice from the IRS or State, Protection Plus will provide up to $1,000,000 of services to find a resolution. And if any of your clients have an identity theft issue, we have a team of experts who can help.

*****DON’T SAY WE DIDN’T WARN YOU*****

Filing Reminders

-

KEY TAX FILING REMINDERS

Form 1095-A from the Health Insurance Marketplace

- Timing: Wait for your Form 1095-A before filing your taxes if you’re eligible for one.

- Inquiries: Unsure if you’ll receive Form 1095-A? Contact the Health Insurance Marketplace at 1-800-318-2596 or visit www.healthcare.gov.

- IRS Requirement: Remember, the IRS requires this form to issue your refund.

6-Digit Identity Theft Protection PIN

- Receipt: If you have a 6-digit PIN from the IRS for identity theft protection, you should have received a letter with your unique PIN.

Retrieval: Haven’t received it? Retrieve your PIN online at IRS Identity Protection PIN

Other Services

*****DON’T STOP READING, YOUR ALMOST DONE*****

OTHER SERVICES

Note: If you’re interested in any of the below services, you can easily opt-in through the ‘Other Services’ section in the 2024 Tax Season Preparation Package. You have the option to have the cost deducted from your refund or you can just send us an email to confirm your choice.

Pricing:

Business (For-Profit) Formation Pricing: $500 (Value of over $1K in services) + Filing Fees

Non-Profit Organization Formation Pricing: Price: $750 (Value of over $1K in services) + Filing Fees

Contact us via email and let our team of experts handle the intricate details of the incorporation and application process, allowing you to concentrate on growing your business.

Business Formation

We are excited to assist you with the essential services required to kickstart the process of establishing your business whether it’s For-Profit or a Non-Profit Business.

Here is an overview of what our services encompass:

Included Services:

- Filing of Articles of Incorporation at the State Level (Note: State Filing Fee of $100 is not included)

- Procurement of an IRS EIN (Federal Employee Identification Number)

- Completing Non-Profit Exemption Application (Non-Profit Organizations Only)

- Acquisition of a Duns & BradStreet D.U.N.S Number

- Domain Registration and Full Domain Protection (GoDaddy – 1-3 year subscription, with a fee of up to $80 not included)

- Professional Email (Microsoft 365 Email Essentials – 1-3 year subscription, with a fee of up to $30 not included)

- Provision of a Professional Business Address (Monthly subscriptions available for as low as $9.99 not included)

Bonus Add-ons (No additional cost):

- Complimentary Standard Bylaws Template (In alignment with IRS Requirements)

- Free Basic Logo with Commercial Rights

- Free Signature Logo

Services Include:

- A one-time BOI Report filing for 2024.

- We gather all necessary information from relevant parties.

- Your involvement is minimal – just complete a simple questionnaire, and we handle the rest.

- Ensure you’re prepared well in advance for this 2024 requirement. Let us take the burden off your shoulders, so you can focus on running your business.

BOI Reporting Service

Important Update for Business Owners: Mandatory Beneficial Ownership (BOI) Reporting

Attention (small) business owners! Starting January 1, 2024, a significant change is coming under the Corporate Transparency Act (CTA). You’ll be required to file a new, detailed report, and failure to comply could lead to severe penalties, including fines and possible imprisonment. Compliance isn’t just advised; it’s mandatory.

To ease this process, we’re offering a Beneficial Ownership Information (BOI) report filing service. Let us handle the intricacies of this new law and save you the hassle of the potentially lengthy 3-hour filing process.

Special Offer: Early Bird Savings

- Lock-In Price: Secure our service now for a BOI Report preparation fee of just $199.

- Save $50: By committing to our services before January 1, 2024, you save on the usual cost of $249.

- Easy Opt-In: Choose our service in the ‘Other Services’ section of your 2024 tax preparation package. For those who don’t opt-in and prefer to have the fee deducted from their refund, the cost will be $249.

Employee Retention Tax Credit Services

Unlock the potential of the Employee Retention Tax Credit and bolster your business’s financial health. The ERTC offers a significant refundable tax credit for businesses that maintained their workforce during challenging periods. Our expert team simplifies this complex process for you. We’ll handle the calculations and necessary paperwork based on your 2020 and 2021 payroll tax returns, ensuring you receive the maximum credit you’re entitled to. Our fee is a straightforward 20% of the credit found, plus a manageable upfront fee.

Get started today and let us navigate you through this rewarding opportunity. With the IRS currently experiencing delays, acting now is crucial to expedite your claim. Contact us via email to enhance your business’s financial resilience through the ERTC.

Note:

For more details and to grab your copy at Amazon.com Get ready to explore the world of Phenny McFee with your family!

Children’s Book

EXCITING ACCOUNCEMENT: MY DEBUT CHILDRENS BOOK

Hello everyone! You know me as A’Driann Roland, your dedicated tax preparer, and the owner of Roland Tax & Financial Solutions. Today, I’m thrilled to share something different and close to my heart – my first self-published children’s book, “Phenny McFee and Her Big ‘Ole Family”!

This book is my labor of love, introducing you to Phenny, a creative and imaginative child who embarks on adventures, learning valuable life lessons and understanding family values along the way.

Packed with over 100 sight words, vibrant illustrations, and cool merchandise, this book not only entertains but also represents children of color, providing a relatable and engaging experience for your little ones.

Financial Literacy

E-Books

DIY FINANCIAL LITERACY E-BOOKS

Note: Our website is under construction and will be available at the beginning of tax season.

We now offer a new line of Do-It-Yourself credit repair and financial literacy E-books with our sister company Easy Disputing.

If paying for credit repair services isn’t in your budget then our Do-It-Yourself packages may be just what you’re looking for!

Please visit Easy Disputing at www.easydisputing.com for more information of services. We have also attached a breakdown of the services.

Okay, that about sums it up! We look forward to serving you in 2024, talk with you soon!

Additional Information

REFERALS

DON’T MISS OUT ON FREE MONEY! ITS EASY, REFER A NEW CLIENT AND RECEIVED $25 PER REFERAL.

GIVEAWAYS

A drawing for 5 – $100 gift cards will be held on April 30, 2024. There will be a total of 5 winners, one $100 gift card each: one winner per household. Winners will be contacted no later than MAY 15, 2024. Grand prize will be announced soon!

FREE SERVICES

- Free FAFSA Assistance to all paying tax clients

- Free Notary Services to all paying tax clients

SOCIAL MEDIA

Follow us to stay updated on the latest News & Important Updates:

Instagram: @RolandTaxSolu

Facebook: facebook.com/rolandtaxandfinancialsolutions